What Should Sellers Do as Mortgage Rates Hit 2 Year High?

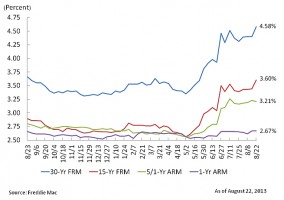

Over the past few months we have seen the real estate market flourish with sales and median price increases. But with these signs of a recovering market we have also started to see mortgage interest rates increase. As of last Thursday 30 year rates hit a 2 year high at 4.58%, 15 year rates took a jump as well up to 3.6%. With investors concerned with the federal government reducing their bond-buying program even these peak rates may not be the ceiling of where rates end up.

Over the past few months we have seen the real estate market flourish with sales and median price increases. But with these signs of a recovering market we have also started to see mortgage interest rates increase. As of last Thursday 30 year rates hit a 2 year high at 4.58%, 15 year rates took a jump as well up to 3.6%. With investors concerned with the federal government reducing their bond-buying program even these peak rates may not be the ceiling of where rates end up.

What does this mean for sellers? Well, it’s not great with this recent bump in rates it will definitely lower the number of qualified candidates who are able to afford buying your home. Although, in the short term with many home buyers worried about increasing rates they may be pushed to act quickly and pay top dollar before they are edged out of the market. Our recommendation for sellers is to sell now if you can, waiting could be detrimental.

Some experts are already predicting a second housing bubble due to the rapid increase in prices if house building does not see a substantial increase. However, with the previous bubble being built on shotty lending and reckless pricing increases the current situation has more stringent mortgage regulation and closely watched prices. With these in place it is unlikely we will experience the same type of disaster as we did a few years ago but it is something for sellers to consider when deciding on whether or not they will sell their home.